Hindustan Copper Limited (HCL) stands as India's sole vertically integrated copper producer, uniquely positioned to capitalize on the global copper supercycle driven by electrification, renewables, and infrastructure demands. As a Miniratna Category-I PSU under the Ministry of Mines, HCL's expansion trajectory, record FY25 financials, and favorable metal prices make it a compelling long-term investment play amid India's push for self-reliance in critical minerals.

Business Profile and Operations

HCL operates across the full copper value chain—from mining and beneficiation at key sites like Malanjkhand Copper Project (MCP, Madhya Pradesh), Khetri Copper Complex (Rajasthan), and Indian Copper Complex (Jharkhand)—to smelting, refining, and downstream products like cathodes and rods. FY24 ore production reached 3.78 MTPA (up 13% YoY), with FY25 targeting 3.9-4 MTPA; reserves swelled by 123 million tonnes over two years via aggressive exploration. Recent milestones include Rakha mine's 20-year lease extension (Sep 2025) and a new ₹400 crore concentrator at MCP, underpinning a ₹2,000 crore capex plan to triple capacity to 12.2 MTPA by FY31.

Financial Performance

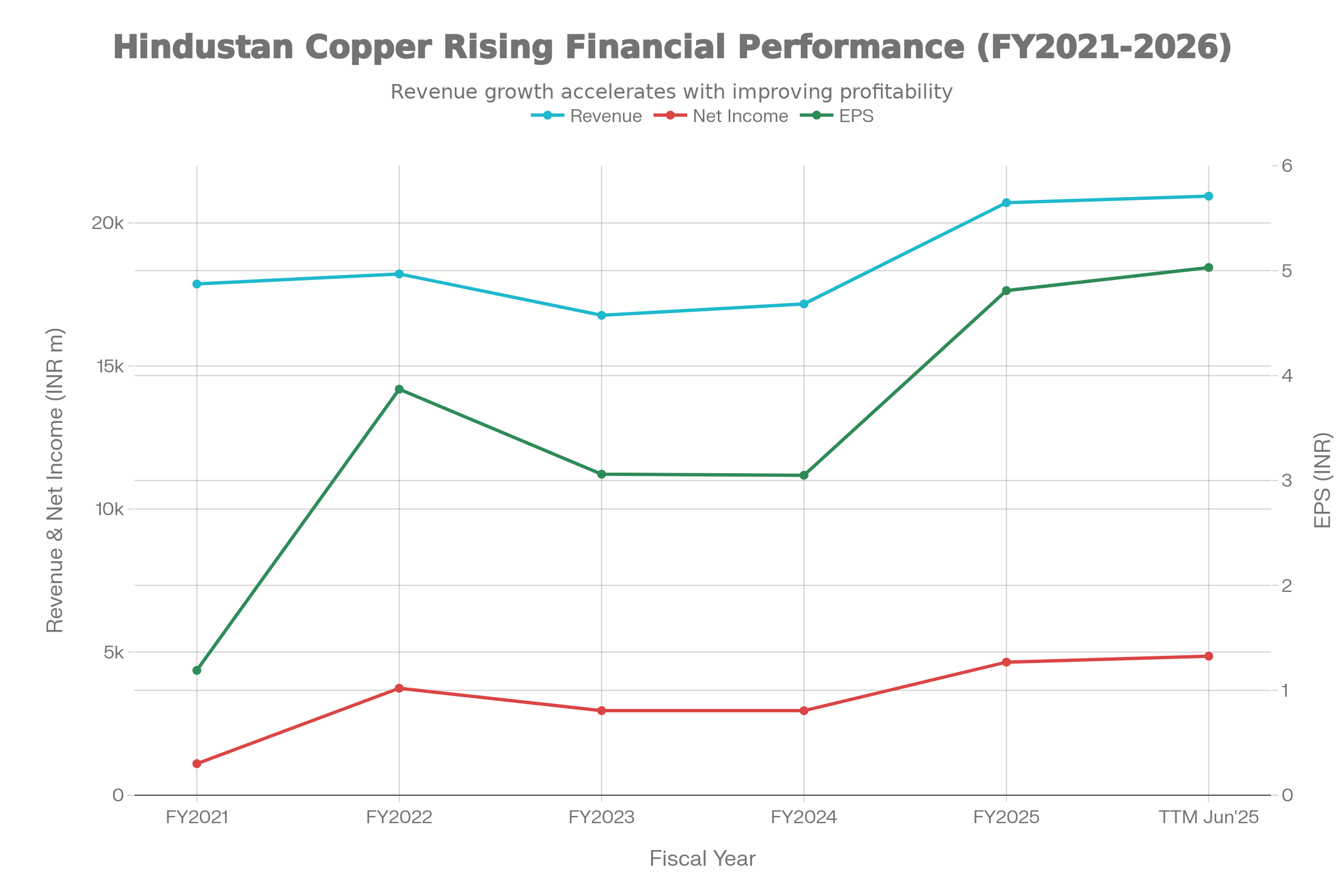

Revenue grew 20.61% YoY to ₹20,710 million in FY2025, driven by higher copper prices and production, with TTM revenue at ₹20,937 million as of June 2025. Net income surged 57.50% to ₹4,651 million in FY2025, yielding a 22.46% profit margin, while EPS rose to ₹4.81 from ₹3.05 in FY2024. Operating margins improved to 30.87% amid controlled costs, with free cash flow turning positive at ₹1,243 million.

Trends in revenue, net income, and EPS from FY2021 to TTM 2026 appear in the chart below.

| Metric |

FY24 |

FY25 |

Q2 FY26 |

5-Yr CAGR |

| Revenue (₹ Cr) |

1,710 |

2,071 |

729 |

22% |

| PAT (₹ Cr) |

331 |

469 |

184 |

35% |

| EBITDA Margin (%) |

28 |

35 |

38 |

- |

| EPS (₹) |

3.40 |

4.82 |

1.89 |

- |

Hindustan Copper Limited trades at a premium valuation, with a current market price around ₹436.55, reflecting strong momentum but raising overvaluation concerns relative to fundamentals.

Key Metrics

Market capitalization stands at approximately ₹422 billion, with an enterprise value near ₹423 billion given minimal net debt. The trailing P/E ratio exceeds 74x based on recent EPS of ₹5.89, far above sector averages for metals, while P/B sits at 13-14x against a book value per share of about ₹31. Price-to-sales hovers around 17-20x TTM revenue, and EV/EBITDA is roughly 28-43x, indicating expensive multiples amid cyclical copper exposure.

DCF Valuation

Using a discounted cash flow model with conservative growth assumptions (5-10% revenue CAGR tied to copper demand, 16-17% WACC reflecting high beta of 2+), intrinsic value estimates range from ₹40-₹125 per share. At current levels, this implies 70-90% overvaluation, as free cash flow remains inconsistent despite profitability surges. Median fair value around ₹122 suggests significant downside risk if growth moderates.

Relative Valuation

Compared to peers like Vedanta or global copper miners, Hindustan Copper's 74x P/E dwarfs typical 10-20x sector norms, justified partly by its Indian monopoly but eroded by commodity volatility. Forward multiples could compress to 30-50x if FY26 EPS hits ₹7-8 on production ramps, yet PEG above 1.9 signals growth not fully pricing in risks.

SWOT Analysis

| Strengths |

Weaknesses |

- Domestic monopoly in integrated copper

- 3x expansion secured by leases/reserves

- High ROE/ROCE, debt-free balance sheet |

- Monsoon-vulnerable output (50% FY25 achieved)

- PSU bureaucracy slows decisions

- Limited scale vs. globals (4 MTPA vs. 100s) |

| Opportunities |

Threats |

- India copper demand +15% CAGR (EVs, solar)

- Global deficit to $12,500/mt (JPM)

- Codelco MoU, JV auctions |

- China slowdown caps prices at $9,000/mt

- Import dumping despite duties

- Capex delays, ESG mining norms |

Bull Case (Base: 60% probability): Copper sustains $11,000-12,500/mt on supply crunch (Grasberg issues) and India Capex (₹100 lakh Cr infra). HCL hits 6 MTPA by FY28 via MCP ramp (5 MTPA) and Rakha; margins hit 40% on spreads. Earnings CAGR 28%, justifying 20x PE.

Bear Case (30% probability): Recession drops copper to $9,000/mt; monsoons/capex slips limit output to 4.5 MTPA. Margins compress to 20%, earnings flatline; stock derates to 8x PE on rotation.

Base Case (10% probability): Moderate $10,500/mt; steady 20% output growth, 25% earnings CAGR.

Investment Outlook and Targets

HCL offers asymmetric upside for patient investors, with execution de-risked by leases and PSUs. Sensitivity: +20% copper price adds ₹200/share NPV; -20% subtracts ₹100. Accumulate on dips below ₹400.

| Horizon |

Target Price (₹) |

Upside from ₹439 |

Rationale |

| 6 Months (Jun 2026) |

520 |

+18% |

Q3FY26 beat, $11,000/mt copper |

| 1 Year (Dec 2026) |

680 |

+55% |

5 MTPA ore, 25% PAT growth |

| 2 Years (Dec 2027) |

900 |

+105% |

MCP doubling, reserves monetized |

| 3 Years (Dec 2028) |

1,200 |

+173% |

8-10 MTPA, 18x PE on ₹65 EPS |

Hindustan Copper Limited presents a high-risk, high-reward investment opportunity, bolstered by its unique position as India's sole integrated copper producer amid surging global demand from EVs, renewables, and infrastructure.

Investment Verdict

Strong FY2025 financials, with revenue up 20% and net income doubling, underscore operational resilience and copper price tailwinds, yet the stock's 74x P/E and 13x P/B ratios signal significant overvaluation relative to intrinsic estimates of ₹100-₹125. Recent price surges to ₹436 reflect momentum, but downside risks loom from commodity volatility and capex strains.

Future Prospects

Expansions at Malanjkhand and new projects could drive 20-25% earnings growth through 2027 if copper averages $9,500/tonne, potentially justifying ₹500+ targets in a bull scenario. Conservative investors should await multiple compression to 40x P/E for entry, while aggressive ones might allocate 5-10% amid diversification. Long-term, the energy transition favors copper plays, positioning Hindustan Copper for outsized returns despite near-term corrections.

Discalimer!

The content provided in this blog article is for educational purposes only. The information presented here is based on the author's research, knowledge, and opinions at the time of writing. Readers are advised to use their discretion and judgment when applying the information from this article. The author and publisher do not assume any responsibility or liability for any consequences resulting from the use of the information provided herein. Additionally, images, content, and trademarks used in this article belong to their respective owners. No copyright infringement is intended on our part. If you believe that any material infringes upon your copyright, please contact us promptly for resolution.